low risk closed end funds

The Advantages and Risks of Closed-End Funds. Say you can borrow money at a 3 short-term rate and invest it in longer-term assets returning 7.

:max_bytes(150000):strip_icc()/dotdash-money_market_savings-Final-6a3f125ef6c74528ab7be85ce42e468c.jpg)

Money Market Fund Vs Mma Vs Savings Account What S The Difference

Invest Online or Over the Phone.

:max_bytes(150000):strip_icc()/pl-flow-b39fbe4dce8d406eb2ebbd4437fa1769.png)

. Free List10 Best Closed-End Funds. Explore High-Yield Income Funds To Help Investors Meet Their Unique Goals. Closed-end funds that invest in common stock and other equity securities are subject to market risk.

Explore High-Yield Income Funds To Help Investors Meet Their Unique Goals. Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can sport high leverage of between. Finding the Best Closed-End Funds By Geoff Considine July 24 2012 Yield-starved investors have ventured into exotic and often risky assets including hedge.

High Dividend Stock Specialists. Ad Find Funds That Outperformed Peers. Refine Your Retirement Strategy with Innovative Tools and Calculators.

What Are Closed-End Funds. -242 82016-112016 15-Year Return. Ad Low-Risk High-Dividing Closed-End Funds.

In the late 1990s and early 2000s nobody. For those seeking to earn higher yields than available from mutual funds closed-end funds can be enticing due to their low-cost leverage. The term feature ensures NAV liquidity upon maturity.

We Offer Over 60 Funds With 4 5 Star Ratings From Morningstar. Closed-end fund definition. Those equity securities can and will fluctuate in value for many.

Ad Wide Range of Investment Choices Access to Smart Tools Objective Research and More. Access Alternative Credit Through CEFs BDCs and REITs with HYIN from WisdomTree. Ad This Alternative Income ETF Seeks to Provide Income While Managing Effects of Rising Rates.

Using those numbers youre making 4 annually on the borrowed funds. Ad For Income-Seeking Investors the Challenge of Finding Durable Income Is a Major Worry. Fidelity Limited-Term Municipal Income FSTFX Morningstar Analyst Rating.

A closed-end fund or CEF is an investment company that is managed by an investment firm. There are also non-listed CEFs with continuous subscriptions and regular typically quarterly. A closed-end fund CEF is a type of mutual fund where investors pool their money and a professional money management team oversees the.

To rehash if the spectrum of risk is between 2 for a very low-risk Treasury fund 4 for a typical fixed income mutual fund and 15 for the SP 500 then CEFs will fit right in. Listed CEFs can offer intra-day liquidity. Example 2 Aberdeen India Fund IFN The Aberdeen India Fund has a long history of wild discountpremium swings.

Closed-end funds raise a certain amount of money. High Yield and Low Risk. Ad For Income-Seeking Investors the Challenge of Finding Durable Income Is a Major Worry.

Rebuilding 60 40 Portfolios With Alternatives Blackrock

:max_bytes(150000):strip_icc()/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

Mutual Funds Different Types And How They Are Priced

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

/dotdash-money_market_savings-Final-6a3f125ef6c74528ab7be85ce42e468c.jpg)

Money Market Fund Vs Mma Vs Savings Account What S The Difference

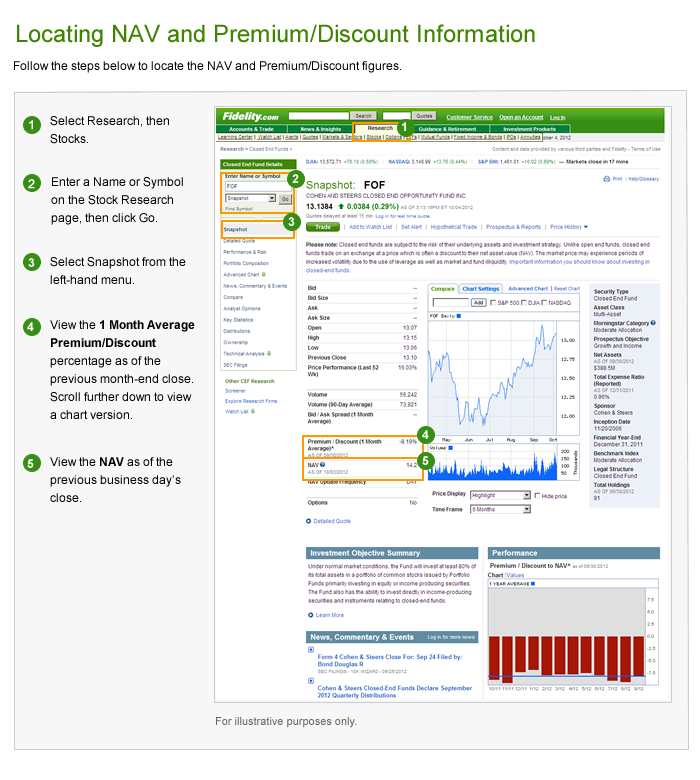

What Are Closed End Funds Fidelity

Closed End Fund Cef Discounts And Premiums Fidelity

Understanding Closed End Vs Open End Funds What S The Difference

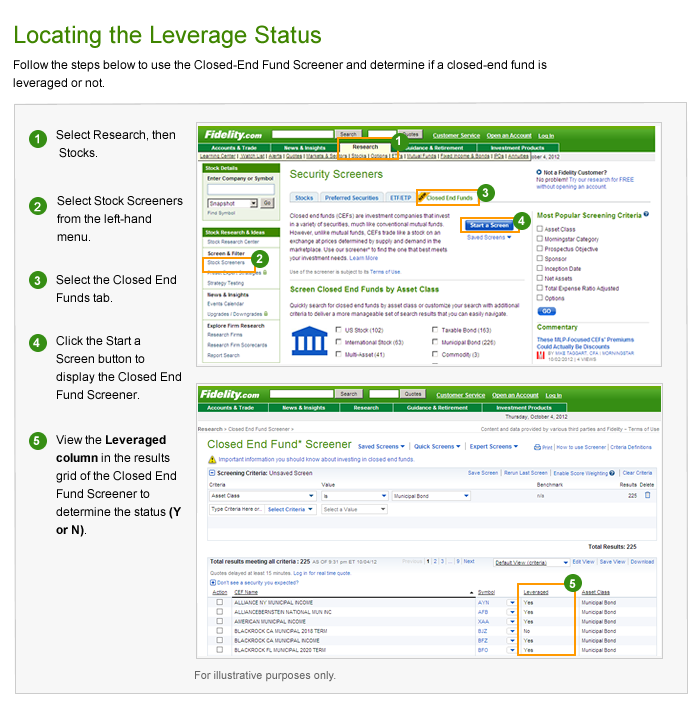

Closed End Fund Leverage Fidelity

/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-01-8a899febd3cd4dba861bd83490608347.jpg)

The Hidden Differences Between Index Funds

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)

:max_bytes(150000):strip_icc():gifv()/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)

:max_bytes(150000):strip_icc()/conservativeportfolio-tardi-d19760c073f44c5b94bf060071963751.jpg)