is car finance interest tax deductible

You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be tax. They enable your company to claim corporation tax relief against the depreciation of assets you buy and use in your trade.

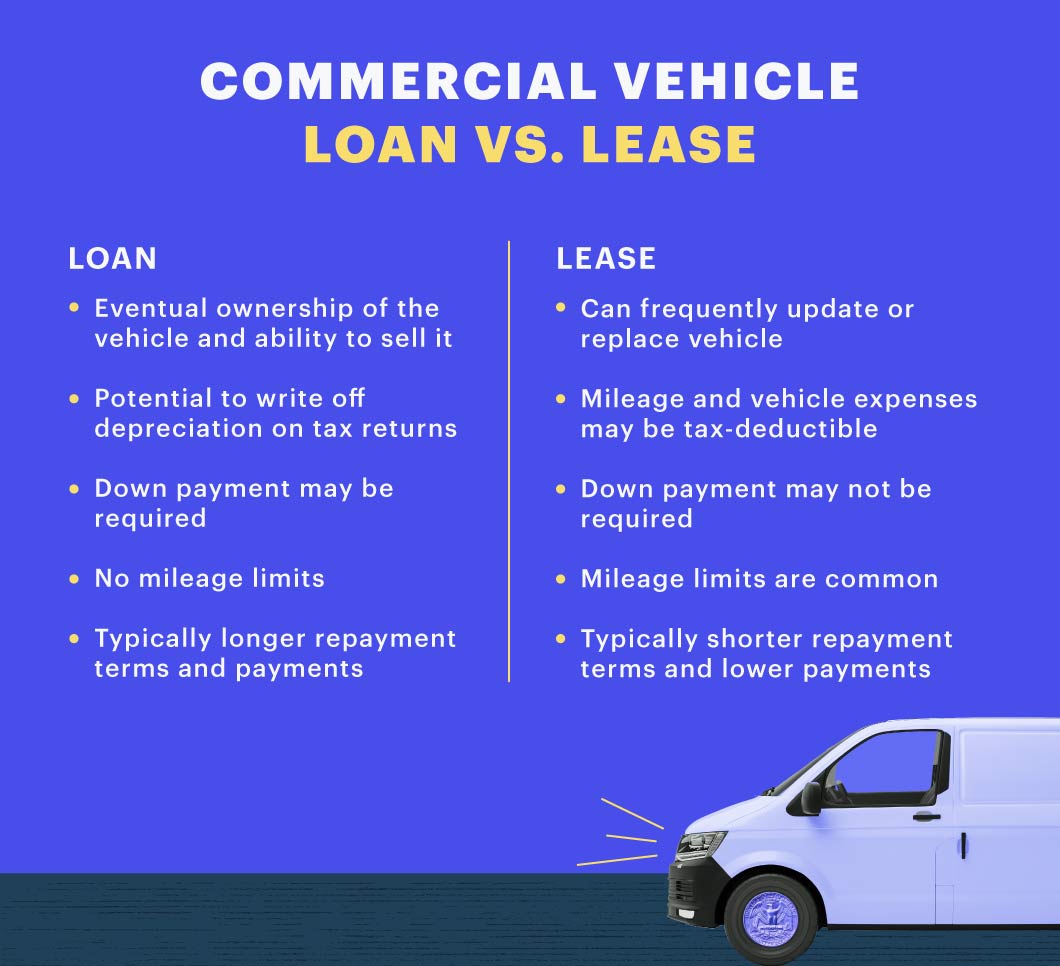

Commercial Vehicle Loan Details And Terms Plus Lenders

How to Determine If Car Finance Payments are Tax-Deductible In Australia Typically you can only deduct car payments from your tax return if you use the car for business uses.

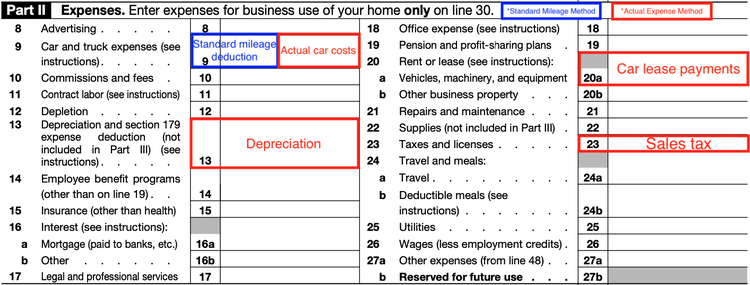

. As a business owner you can claim a tax deduction for expenses for motor vehicles cars and certain other vehicles used in running your business. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be tax deductible. For example if you took out a loan or car finance.

If you have a vehicle thats used partly for business and partly for personal use the interest is deducted as the percentage that the car is used in your business. The answer to is car loan interest tax deductible is normally no. They vary according to the type of equipment.

You can only write off a portion of your car expenses equal to the business use of the car. March 13 2019. But you can deduct these costs from your income tax if its a business car.

More specifically if you borrowed money to buy a car you may well be asking are car loan payments tax deductible The answer to this is possibly but it depends on a number of. In situations where you bought a car for your company your claim would have to depend on how the vehicle was financed. This is why you need to list your vehicle as a business expense if you wish to deduct the interest youre.

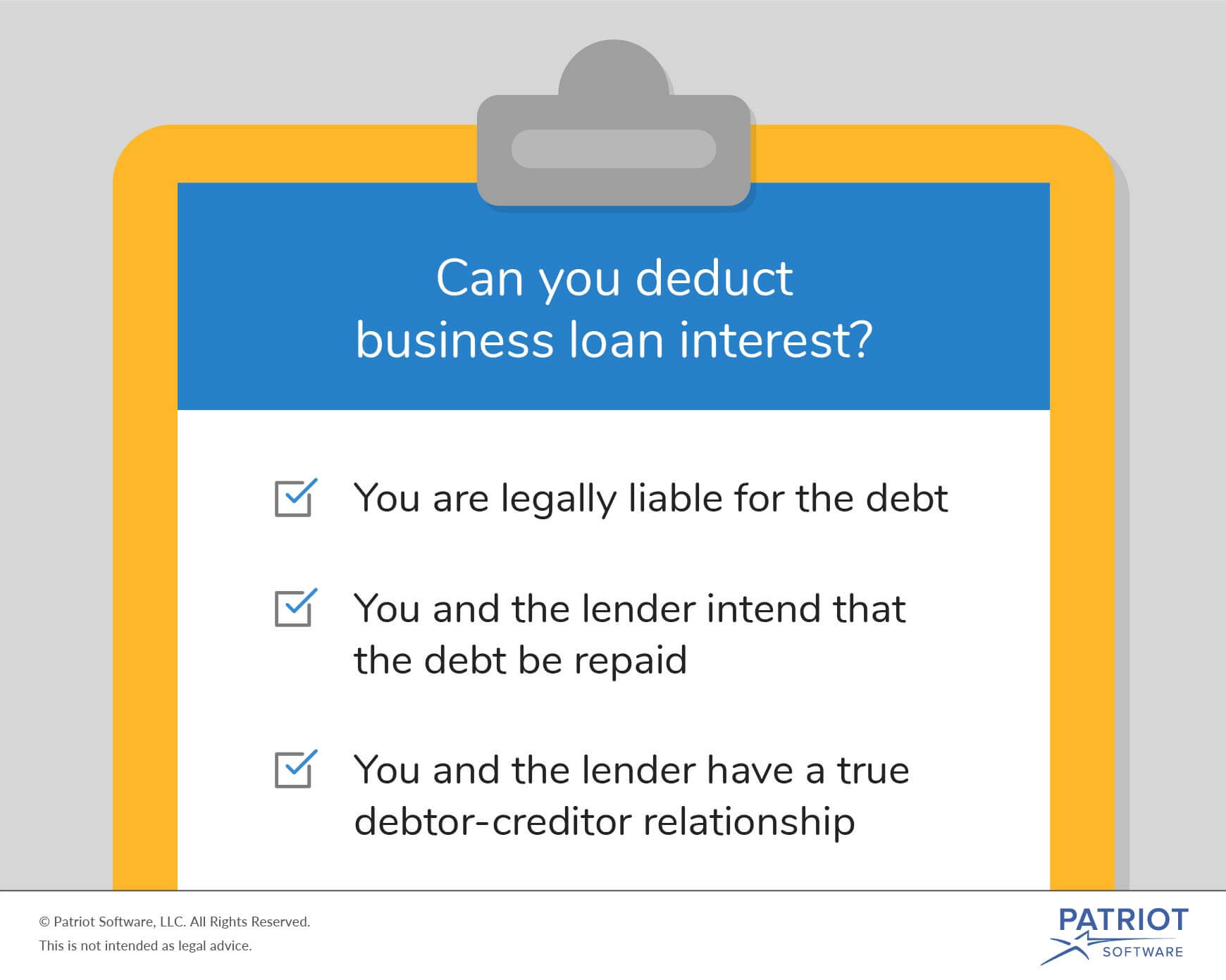

You can deduct interest on the money you borrow to buy a motor vehicle zero-emission vehicle passenger vehicle or a zero-emission passenger vehicle you use to earn business. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be tax. The interest payments made on certain loan repayments can be claimed as a tax deduction on the borrowers federal income.

Ato Go to atogovau. Credit card interest usually isnt tax deductible but if youre a small business owner there are some exceptions Hanna Horvath 2020-03-03T190000Z. Any business with a.

Interest on car loans may be deductible if you use the car to help you earn income. Interest on loans is deductible under CRA-approved allowable motor vehicle. Experts agree that auto loan interest charges arent inherently deductible.

When you finance a new vehicle that you intend to use for work you cant deduct the entire monthly bill from your taxes. If a self-employed person uses their car for business 40 percent of the time and personal use 60 percent of the time then the person can only deduct 40 percent of the loan. Deducting interest for financed vehicles.

It can also be a vehicle you use for both. Within the past few years the Australian government has begun offering 150000 in tax rebates for small business owners who purchase vehicles for business use. If your car use is 70 business and 30 personal you can only deduct 60 of your auto loan interest.

If you bought the car for 100 business use only you can deduct 100 of the interest. Are car loan interest payments tax deductible.

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

How Home Equity Loan Interest Tax Deduction Works

Student Loan Tax Deductions Education Credits Save On Your Taxes

How To Calculate Auto Loan Payments With Pictures Wikihow

Five Types Of Interest Expense Three Sets Of New Rules

The Ultimate List Of Tax Deductions For Online Sellers In 2020 Gusto

Is A Car Loan Interest Tax Deductible Mileiq

Are Mortgage Payments Tax Deductible Taxact Blog

How To Claim Your New Car As Tax Deductible Yourmechanic Advice

All About Mileage Levesque Associates

Mortgage Interest Tax Deduction What You Need To Know

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Underwriting 101 Auto Finance How Are Car Loans Approved

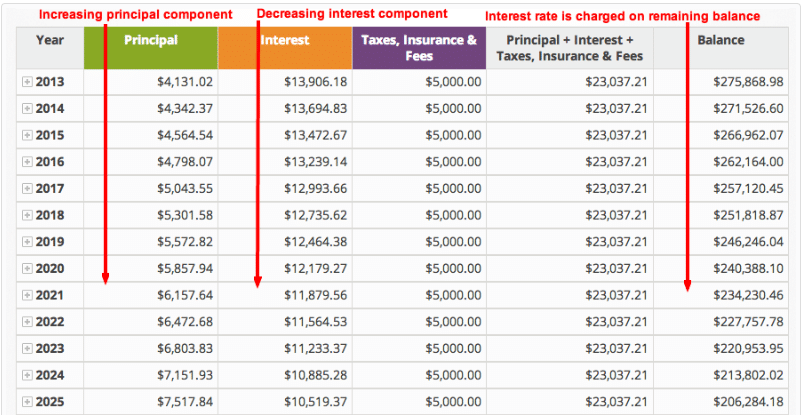

How To Calculate Amortization Expense For Tax Deductions

Are Medical Expenses Tax Deductible

How To Take A Tax Deduction For The Business Use Of Your Car

Tax Deductions Guide Sunlight Tax

What Is The Business Loan Interest Tax Deduction